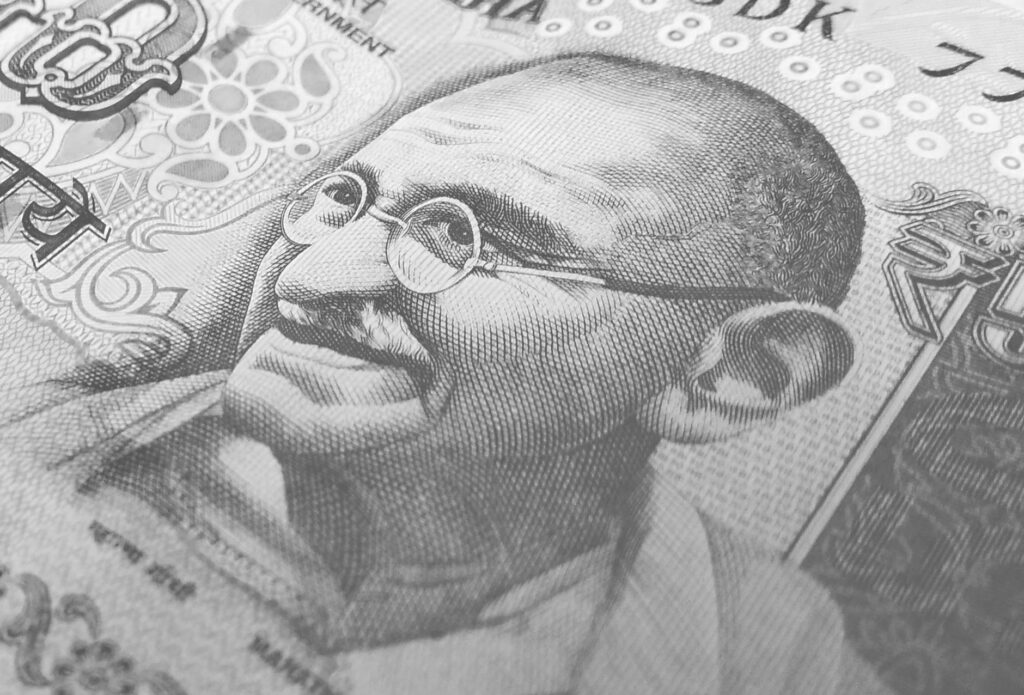

The currency breaches the critical 90-mark as foreign investors pull out billions, Signalling tougher times for importers and consumers

The Indian currency has officially entered uncharted territory. In a turbulent session on Monday, the Indian rupee hits new record low against US dollar, touching an unprecedented intra-day depth of 90.75. This sharp decline marks a significant psychological breach, as the currency had hovered near the 89-level for months. Market data indicate that the rupee is now the worst-performing Asian currency of 2025, having depreciated by over 6 per cent this year alone. While domestic equity markets showed some resilience, the forex markets reflected deep anxiety regarding India’s external trade environment.

Also Read: Haryana Secures ₹2,750 Crore World Bank Loan to Combat Toxic Air

The Double Whammy: Tariffs and Outflows

Two primary factors are driving this downward spiral. First, the ongoing stalemate in trade negotiations with the United States has spooked investors. With Washington imposing punitive tariffs of up to 50 per cent on specific Indian goods, the export outlook has dimmed significantly. Second, foreign portfolio investors (FPIs) are exiting Indian markets at a record pace. Data reveals that overseas funds have pulled out nearly $19 billion from Indian equities in 2025. Consequently, the massive demand for dollars to repatriate these funds has created immense pressure on the local unit, ensuring that the Indian rupee hits new record low against US dollar repeatedly this month.

Impact on Your Wallet

For the average citizen, this depreciation signals potential inflationary trouble. A weaker rupee immediately inflates the import bill, particularly for crude oil and gold, which are purchased in dollars. Although global oil prices have been relatively stable, the exchange rate loss means Indian oil marketing companies are paying more for every barrel. This cost is inevitably passed down to consumers through higher fuel prices and transport costs. Furthermore, electronics and overseas education will become significantly more expensive. Therefore, as the Indian rupee hits new record low against US dollar, study-abroad aspirations and luxury consumption will face a steep financial reality check.

RBI’s Calculated Silence

Market watchers have noted a distinct shift in the Reserve Bank of India’s (RBI) strategy. Unlike previous episodes where the central bank aggressively sold billions of dollars to defend a specific level, its current intervention appears far more passive. The RBI seems to be prioritising the preservation of its foreign exchange reserves, which stand at $687 billion, over artificially propping up the currency. This “hands-off” approach suggests that the central bank views the depreciation as a necessary adjustment to align with global market realities. Thus, without heavy intervention, it is likely that the Indian rupee hits new record low against US dollar again in the coming weeks.

The Hinge Point

The headlines blame the trade war, but the deeper, under-reported issue is the “GDP-Currency Divergence.” It is economically paradoxical that India is posting a robust 8 per cent GDP growth, the highest among major economies, while its currency is the region’s worst performer. This signals a structural fragility in India’s “capital account.” The growth is internally driven by consumption and infrastructure, but the external financial plumbing remains dangerously dependent on “hot money” (short-term foreign investment). The fact that the Indian rupee hits new record low against US dollar despite record growth proves that foreign capital still treats India as a risky emerging market, not a stable economic superpower.